Revolutionizing Wealth Harnessing the Power of AI Bot for Trading on Financial Markets

Revolutionizing Wealth: Harnessing the Power of AI Bot for Trading on Financial Markets

In the convenience-driven modern financial world, the ai bot for trading on pocket option https://pocketoption-forex.com/bezopasnot/ various platforms has emerged as a groundbreaking solution for both novice and experienced investors alike. This innovative technology has transformed the tools and strategies available to traders, allowing them to make informed decisions with unprecedented speed and accuracy. As we delve deeper into the world of trading automation, we will explore the benefits, mechanisms, and future of AI trading bots, illustrating how they can reshape the landscape of investment.

The Rise of AI in Trading

The integration of artificial intelligence into trading platforms can be traced back to the early 2000s, with algorithmic trading systems gaining traction in stock and currency markets. However, the introduction of machine learning and deep learning technologies has catalyzed a significant evolution in trading bots over the last few years. These advanced AI systems possess the ability to analyze vast datasets in real-time, enabling them to identify patterns, predict market trends, and execute trades effectively. As a result, traders are not only provided with a competitive edge but also the ability to operate around the clock.

Benefits of AI Trading Bots

The proliferation of AI bots in trading is fueled by their myriad advantages. Here are some of the most notable benefits:

- Increased Trading Efficiency: AI bots can process information faster than any human trader. By continuously scanning the markets for opportunities, they can execute trades within milliseconds, maximizing profit potentials.

- Emotional Discipline: One of the most significant hurdles for traders is managing emotions, especially in volatile markets. AI bots operate based on data and predefined strategies, eliminating the risk of emotional decision-making.

- Data-Driven Insights: These bots use complex algorithms to analyze past market behavior. This analysis leads to more informed trading decisions, as they can perceive trends and predict future movements that may not be apparent to human traders.

- 24/7 Trading Capability: Unlike human traders, AI bots can trade around the clock, allowing them to capitalize on opportunities at any time of day, irrespective of market conditions or time zones.

- Backtesting Strategies: Traders can use AI bots to backtest their strategies on historical data, allowing them to refine and improve their trading methodologies before committing real capital.

How AI Trading Bots Work

AI trading bots utilize machine learning algorithms, big data analytics, and advanced statistical techniques to make trading decisions. Here’s a simplified breakdown of their functionality:

- Data Collection: The bot collects data from various sources, including historical data from exchanges, real-time market data, and alternative data (such as news feeds and social media).

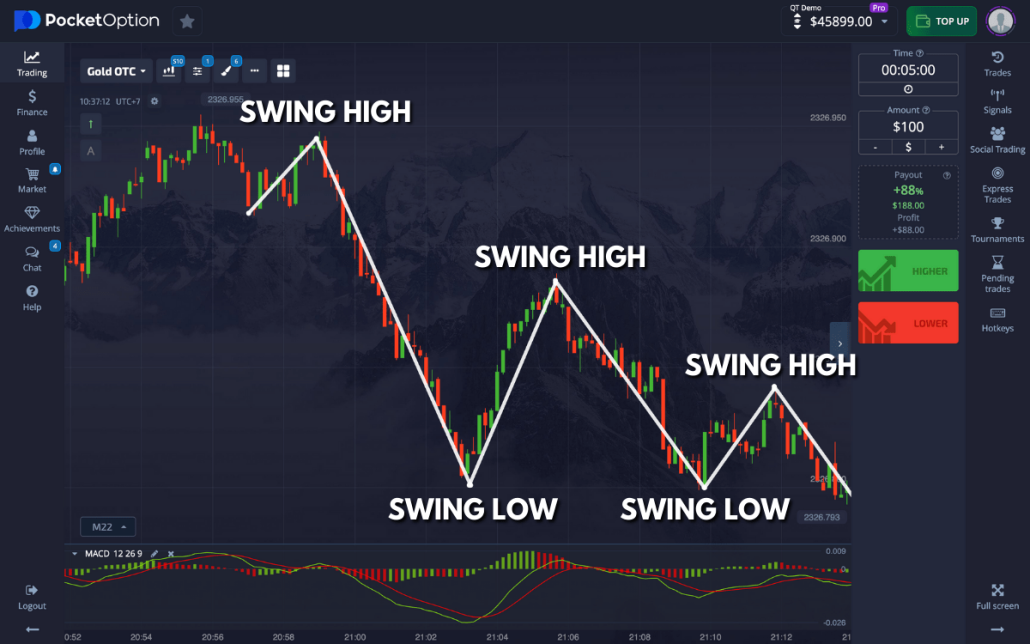

- Analysis and Pattern Recognition: Using machine learning algorithms, the bot analyzes the data to identify trading patterns and correlations between different assets.

- Backtesting: The bot simulates trading strategies using historical data to evaluate potential profitability and risk, optimizing its approach before implementing it in real-time.

- Execution: Once the bot identifies a profitable opportunity, it automatically executes the trade, adhering to specified parameters without delay.

- Continuous Learning: AI bots continually learn from new data and trading outcomes, allowing them to adapt and improve their strategies over time.

Challenges and Considerations

Despite their advantages, AI trading bots come with their own set of challenges and considerations that traders must bear in mind:

- Market Volatility: AI bots can struggle during highly volatile market conditions, as their algorithms may not react quickly enough to rapid changes in price.

- Dependence on Data Quality: The effectiveness of an AI trading bot relies heavily on the quality and accuracy of the data it uses. Poor-quality data can lead to erroneous decisions.

- Technical Glitches: As with any technology, AI trading bots are susceptible to bugs and technical issues that can disrupt trading activity, potentially leading to substantial losses.

- Regulatory Challenges: The trading landscape is continuously evolving with regulatory scrutiny on AI and algorithmic trading, which may affect how bots operate.

- Initial Costs: While many trading bots offer their services at competitive rates, the initial cost of subscription or purchase can be a barrier for some traders.

The Future of AI in Trading

The future of AI trading bots looks promising. As technology continues to advance, we can expect more sophisticated algorithms that can not only identify but also react to market changes in real-time, becoming more autonomous in their decision-making processes. Moreover, the integration of natural language processing (NLP) may enable these bots to interpret news and sentiment data more effectively, providing a more holistic view of the market dynamics.

Additionally, collaboration between AI developers and financial institutions may lead to the creation of hybrid models that leverage human expertise alongside AI analysis, resulting in a comprehensive trading ecosystem that combines human creativity with machine efficiency. This could further enhance the accessibility of AI trading bots, democratizing financial trading for individuals across various skill levels.

Conclusion

In conclusion, the advent of the AI bot for trading on financial markets marks a significant shift in the way trading is approached. With their ability to process vast amounts of data rapidly and execute trades without emotional interference, these bots empower traders to make smarter, more informed decisions. While there are challenges to be mindful of, the future holds immense potential for increasing efficiency, profitability, and accessibility in the trading world. Embracing AI technology in trading not only enhances individual trading strategies but also represents a broader evolution towards a more data-driven financial industry.

Add Comment